Abacus Credit Impact

Transparency in sustainability

Our ESG vision

The fund’s objective is to invest in bonds with environmental and/or social sustainability impacts while seeking performance over the recommended investment period.

The fund has a sustainable investment objective in accordance with Article 9 of the SFDR Regulation (EU) 2019/2088.

Abacus Credit Impact adopts a comprehensive extra-financial strategy. In particular, the Fund’s ESG analysis restricts the investment universe as a priority over financial analysis. The Fund filters the investment universe according to the alignment of bonds with the standards of the International Capital Market Association (“ICMA”), in particular the Green Bond Principles (GBP), Social Bond Principles (SBP), Sustainability Bond Guidelines (SBG), Sustainability Linked Bond Principles (SLBP) (referred to here as the “Principles”). In addition, the fund uses several approaches:

- Normative exclusions: excluding companies involved in controversial weapons and companies found to be in breach of the 10 principles of the United Nations Global Compact and the OECD Guidelines;

- Sectoral exclusions: fossil fuels, coal-fired electricity, tobacco and the adult entertainment industry;

- “Best-in-Universe;

- Analysis of ESG risks and impacts;

- Analysis of greenhouse gas emissions, perimeters 1,2,3 ;

- Positive impact and sustainability analysis;

- Dialogue with companies to deepen our analysis and encourage positive impact

- Monitoring of risks and controversies.

Do no harm

“This product aims at investing sustainably.”

The Fund ensures that it is aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight core conventions identified in the International Labour Organisation’s Declaration on Fundamental Principles and Rights at Work and the Human Rights Charter.

This alignment is verified and monitored at the level of the investable universe. A company found to be in violation of these Principles is excluded from the investable universe.

Sustainable investment objective

Objective of contributing to the ecological and energy transition through investment in four categories of bonds

Green bonds

Social bonds

Sustainability bonds

Sustainability linked bonds

Investment strategy

1 – OUR PHILOSOPHY

Our socially responsible and sustainability-conscious convictions drive our extra-financial strategy and investment guidelines.

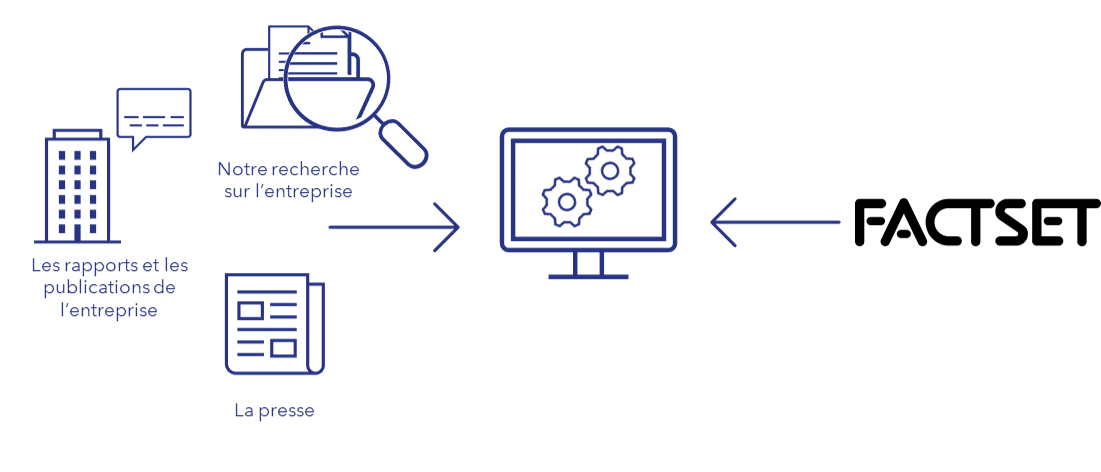

2 – RESEARCH AND ANALYSIS

We perform our due diligence and ESG analysis on each company.

We conduct an in-depth analysis of the company’s activities, responsible approach and corporate culture.

Our analysis is done in-house using a proprietary tool.

With raw data, collected directly from the company, its reports and publications.

Our analysis is based on quantitative data, supplemented and contextualised by qualitative data.

3 – COMMITMENT AND STEWARDSHIP

We actively engage the company in order to collect data from the management and to discuss possible ways of improvement.

4 – KPI AND TRANSPARENCY

In order to ensure a minimum ESG threshold, for each fund a specific approach is assigned.

In addition, we strive to achieve an ESG performance of the portfolio above that of its benchmark.

We analyse and monitor around 130 KPIs including footprint and emissions intensity for all portfolios. We consider scopes 1, 2 and 3.

The ESG performance of our funds is subject to regular monthly and annual reporting.

The 5 postulates of our extra-financial strategy

REDUCE THE RISKS

Preventing negative impact on value and the environment

Normative and sectoral exclusions

ESG analysis based on double materiality

Pragmatic and objective management of controversies

SEIZE THE OPPORTUNITIES

Focusing on and encouraging positive impact

Positive impact measurement

Constructive and proactive dialogue

Objectives of the fund

Minimum investability threshold

The entire universe is rated and 20% of worst rated companies are excluded

ESG analysis coverage rate

More than 90% by weighting

ESG rating

Higher than benchmark

Sustainable investment

80% of net assets

Exposures

Exposure to sustainable development

The sustainable investment rate is calculated internally, taking into account three criteria: substantial contribution to one or more of the SDGs, absence of significant harm and good governance.

The sustainability calculation distinguishes between environmental objectives linked to clean water (SDG 6), clean energy (SDG 7), sustainable consumption (SDG 12), the fight against climate change (SDG 13) and biodiversity (SDG 15), and social objectives linked to human health (SDG 3), quality training and education (SDG 4), gender equality (SDG 5), decent work (SDG 8), and the reduction of inequalities (SDG 10).

Monitoring the sustainable investment objective

Measuring emissions' sustainability

Ensures a sustainable world

Four types aligned with ICMA standards:

- Green bonds

- Social bonds

- Sustainability bonds

- Sustainability Linked bonds

Four criteria:

- Existence of a sustainability indicator (Green, Social, Sustainability)

- ESG transparency

- Allocation of funds to sustainable projects

- Management of funds in accordance with ICMA standards

Measuring issuers' sustainability

Ensures the construction of a sustainable portfolio

Three criteria:

- substantial contribution to one or more of the SDGs

- absence of significant harm

- good governance.

Significant contribution to:

Methodology

Normative and sectoral exclusions

Best in universe

ESG analysis based on double materiality

Positive impact measurement

Analysis of greenhouse gas emissions

Sustainable investment goal

The fund calculates the sustainable investment rate for issuers. This calculation is carried out in-house using a proprietary tool that takes three criteria into account: substantial contribution to one or more sustainable development goals (SDGs), absence of significant harm and good governance.

For more information:

Sources and data

External data - internal tools and analysis

We attach great importance to the development of proprietary models built on our expertise to provide tangible added value in the application of our non-financial strategy. Our analysis and monitoring tools respect this principle and aim to offer results that we control as a whole.

Our proprietary tools developed on the basis of international standards

The management team is responsible for scientific, technical and regulatory monitoring in terms of tool development and extra-financial management. It relies on international standards:

- UN Sustainable Development Goals (SDGs) for their granularity and in-depth, global approach.

- The Global Reporting Initiative (GRI) and Carbon Disclosure Project (CDP), for their relevant publications and their work on improving transparency in the extra-financial field;

- Documentary sources published by European Union bodies such as the European Securities and Markets Authority (ESMA) and the European Environment Agency (EEA).

- Publications from national public authorities such as, for France, the French Environment and Energy Management Agency (ADEME) and the French Financial Management Agency (AFG);

Methodological limitations

The ESG analysis adopted is based mainly on qualitative and quantitative data provided by the companies themselves. It therefore depends on the heterogeneity of the quality of this information and the quantity of data available. To fill any gaps, the fund contacts companies to obtain the necessary information through ESG questionnaires.

ESG data received from third parties may be incomplete, inaccurate or unavailable from time to time. There may also be a size bias, as large caps have more budget allocated to their responsible and CSR approach.

Carbon analysis is limited by the lack of a clearly defined reporting framework. The methods used by companies to calculate their CO2 emissions may vary in quality as well as in quantity. Thus, the data published by companies may be based on different perimeters of induced emissions (Scope 1, 2, 3). In particular, Scope 3 emissions are often unavailable. All of this can affect the calculation of the portfolio’s overall footprint.

Duty of care

Monitoring of the investable universe :

- Exclusions according to our Exclusion Policy

- Analysis of controversies and risks

- Entitled ESG analysis, with the exclusion of 20% of the worst rated companies (Best in Universe)

Daily monitoring and updating

Portfolio monitoring :

- In-depth ESG analysis

- Impact and sustainability analysis

- Controversy monitoring

Daily monitoring, data update at least annually, ad hoc in case of controversies

Spot check of investability and ESG risk before an order is filled

Updating and monitoring daily ESG ratios.

Daily monitoring of the achievement of ESG objectives within the portfolio:

- Rating above the benchmark

- ESG analysis coverage rate >90%.

- Investability rate >90%.

We communicate with companies on the subject of their responsible approach.

We make contact on several occasions:

- Occasionally, in order to deepen our analysis

- Regularly at ESG forums

- At the request of the company

The management team is also responsible for the identification, measurement and control, at the first level, of the risks related to the implementation of the extra-financial approach within the managed portfolios. These risks are controlled at the second level by the management company’s Middle Office Risk, with the support of the permanent control delegate.

Commitment

Philippe Hottinguer Gestion wishes to promote the consideration of the extra-financial sphere among its clients and investors. The company encourages the integration of ESG factors into the decision-making processes and activities of the companies in which it invests.

The company is committed to the UN Principles for Responsible Investment, to the 6 Principles for Responsible Investment, including those relating to shareholder engagement. We are committed to

- Being active shareholders, integrating ESG issues into our shareholding policies and procedures.

- Encourage the companies in which we invest to publish information about their ESG practices.

- Promote the adoption and implementation of the Principles in the investment industry.

- Cooperate to improve the effectiveness of our implementation of the Principles.

To this end, we have planned several engagement approaches.

Collaborative commitment

Promoting and sharing knowledge on sustainable finance issues

Forums, conferences…

Collaborative platforms

Individual commitment

Protecting and improving the investment process, monitoring ESG performance and encouraging the positive impact of assets

ESG Questionnaire

Constructive and proactive dialogue

Votes at meetings

Aligned with the company’s investment objectives and principles

Votes at meetings

Achieving the sustainable investment objective

Benchmark index: Bloomberg MSCI Euro Aggregate Corporate 5-7 Year Index

The benchmark follows the same ESG rating strategy with the same KPIs, calculation methods and is rated using the same variable materiality as the portfolio. Compliance with the portfolio’s sustainability objectives is measured daily. This is done in part by using the ESG rating of the benchmark. Other KPIs, such as carbon intensity or footprint, are monitored regularly and reported on a monthly basis. In this sense, the benchmark is continuously monitored and ensured to be aligned with the environmental and social characteristics promoted by the financial product.

The respective ESG scores of the investable universe and the benchmark are weighted by their capitalisation and updated daily to ensure continuous alignment with each ESG objective of the portfolio.

We use the same methodology for calculating the ESG factors of the index and the portfolio. Our responsible investment policy details the methodology applied.